Payroll calculator with overtime and taxes

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Overtime Hourly Wage.

Salary Slip Templates 20 Ms Word Excel Formats Samples Forms Payroll Template Invoice Template Word Money Template

B A OVWK.

. 11 hourly wage 15 overtime rate 1650 overtime rate of pay. Ad Payroll So Easy You Can Set It Up Run It Yourself. Discover ADP Payroll Benefits Insurance Time Talent HR More.

This is double-time pay which is not included in this payroll calculator. Get an accurate picture of the employees gross pay. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Household Payroll And Nanny Taxes Done Easy. The simplest way to work out how much youll be taxed is to add. Overtime payments are commonly called the overtime premium or the overtime rate of payThe most usual rate for overtime hours is time and a half and that is 50 more.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Use this calculator to help you determine your paycheck for hourly wages. Regular pay of 15 8 hours 120.

All Services Backed by Tax Guarantee. 1650 overtime rate of pay 5. Overtime pay per period.

Fill in the employees federal tax information. Social Security tax rate. Ad Compare This Years Top 5 Free Payroll Software.

Wage for the day 120 11250 23250. Discover ADP Payroll Benefits Insurance Time Talent HR More. The rates have gone up over time though the rate has been largely unchanged since 1992.

Net pay would deduct taxes Social Security Medicare local state and federal taxes health insurance. Free Unbiased Reviews Top Picks. Next calculate Mollys overtime wages.

A RHPR OVTM. Get Started With ADP Payroll. For employees who are paid an annual salary gross pay is calculated by dividing their annual salary by the number of pay periods in a year.

Ad Process Payroll Faster Easier With ADP Payroll. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Overtime pay per year.

Ad No more forgotten entries inaccurate payroll or broken hearts. Dont forget that this is the minimum figure as laid. 15 times 10 hours is 15.

Affordable Easy-to-Use Try Now. The tool calculates overtime pay using time and a half. Find 10 Best Payroll Services Systems 2022.

Time and attendance software with project tracking to help you be more efficient. Then enter the hours you. Some states follow the federal tax.

So if they made 1000 in regular. If youre running your first payroll for an employee who worked overtime deduct taxes from the sum of their overtime and regular earnings. Customized Payroll Solutions to Suit Your Needs.

Overtime Hours per pay period. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Compare the Best Now.

Computes federal and state tax withholding for. SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes. Overtime Calculator More - Free.

The algorithm behind this overtime calculator is based on these formulas. Federal payroll tax rates for 2022 are. First calculate Mollys regular wages.

EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. C B PAPR. Well Do The Work For You.

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. Using an internet overtime tax calculator can make calculating tax easy but you can also work out the number for yourself. See where that hard-earned money goes - Federal Income Tax Social Security and.

Ad Designed for small business ezPaycheck is easy-to-use and flexible. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations. First enter your current payroll information and deductions.

For example if an employee earned an annual. Here When it Matters Most. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Get Started With ADP Payroll. Overtime pay of 15 5 hours 15 OT rate 11250.

It does calculate net pay. This calculator determines the gross earnings for a week. However because he worked an extra 10 hours his overtime pay would be calculated by multiplying 10 by one and a half times 15 the extra working hours.

Ad Process Payroll Faster Easier With ADP Payroll. The state tax year is also 12 months but it differs from state to state.

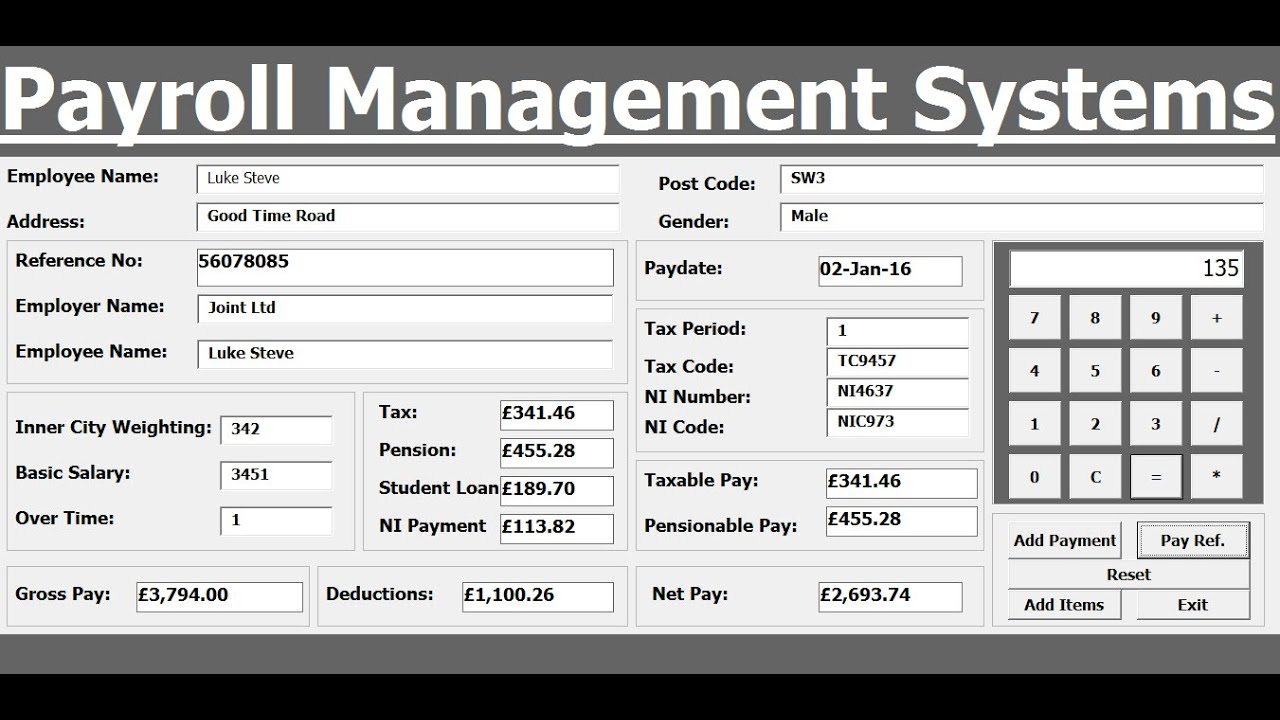

How To Create Payroll Management Systems In Excel Using Vba Youtube Management Payroll Excel

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Payroll Template Bookkeeping Templates

Salary Calculator Template Google Docs Google Sheets Excel Apple Numbers Template Net Salary Calculator Salary Calculator

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Printable Worksheets

Payroll Templates 14 Printable Word Excel Formats Samples Forms Payroll Template Payroll Excel Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Fitness Workout Schedule Sample Workout Calendar Workout Schedule Excel Calendar Template

Price Quotation Templates 10 Free Docs Xlsx Pdf Technology Quotes Quotations Excel Templates

Accounting Worksheet Template Double Entry Bookkeeping Bookkeeping Templates Worksheet Template Spreadsheet Template

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

Monthly Budget Worksheet Excel Http Templatedocs Net Budget Spreadsheet Template Ex Budget Worksheets Excel Budget Spreadsheet Template Excel Budget Template

Hotel Bill Receipt Template Word Format Receipt Template Invoice Template Word Word Template

Employee Vacation Accrual Spreadsheet Excel Budget Budget Spreadsheet Template Payroll Template

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Employee Payroll Ledger Template Google Search Bookkeeping Templates Payroll Payroll Template